11/15/2019

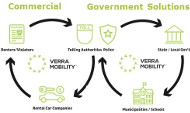

Speed Camera Firm Boasts Of Improved ProfitsDebt-laden speed camera and tolling firm Verra Mobility outlines its plan to raise cash from motorists and investors.

Verra Mobility (formerly American Traffic Solutions) on Wednesday announced a secondary stock offering meant to raise $230 million for the tolling and speed camera giant. ATS founders Jim and Adam Tuton sold their controlling stake in ATS to the merger and acquisition firm Platinum Equity last year. The new firm's primary goal is to raise the cash it desperately needs.

"We have a substantial amount of debt, including approximately $906 million outstanding under our first lien term loan facility," the firm told shareholders in a prospectus on the stock offering. "Our substantial debt could have important consequences. For example, it could.... make it more difficult for us to satisfy our general business obligations, including our obligations to our lenders, resulting in possible defaults on and acceleration of such indebtedness. To service our indebtedness, we will require a significant amount of cash."

Unlike its money-losing photo enforcement competitor, Redflex Traffic Systems of Australia, Verra Mobility scored $24.1 million in profit in the last nine months. The company even turned around losses from the nearly complete ban on red light cameras in Texas by landing the lucrative contract to operate 300 photo radar units in New York City. Each of those cameras is designed to generate $46,000 in annual net profit for the company.

"If you recall, Texas banned red light photo enforcement earlier in the year, resulting in a $11 million annual reduction of revenue, which will impact us for the next three quarters," Verra Mobility chief financial officer Patricia D. Chiodo explained last week. "The speed camera installations in 2019 will add more than $13 million to our annual recurring service revenue."

Verra Mobility's bigger push, however, is in collecting money from motorists who rent cars, use toll roads or are forced to pay London-style congestion taxes. While lucrative, this line of work carries vulnerabilities similar to those found in photo enforcement.

"Our business is dependent on certain key customers, including those in the RAC [rent-a-car] industry," the company told shareholders. "In 2017, Verra Mobility generated a substantial amount of its revenues from RAC customers such as The Hertz Corporation, Avis Budget Group and Enterprise Holdings Inc... Our commercial services business may be materially impacted if there is an unfavorable shift in political support for or public sentiment towards tolling or its use is materially restricted or limited, including through the imposition of limits on the fees RAC companies can charge their customers for tolling services."

Officials in Florida and California have successfully sued Verra Mobility (under the name ATS PlatePass), claiming the company duped consumers into paying massively inflated "convenience fees" on toll roads.