Article from: www.thenewspaper.com/news/39/3995.asp

1/10/2013

GAO Report Pushes Per-Mile Taxation

Government report argues in favor of implementing some form of per-mile tax, despite inherent inefficiency.

The Government Accountability Office (GAO) believes lawmakers should tax motorists for every mile they drive. In a report released Tuesday, the congressional watchdog agency suggested GPS surveillance devices or other, less invasive techniques could be used to more than double the amount of money motorists currently pay in federal gas tax fees.

The Government Accountability Office (GAO) believes lawmakers should tax motorists for every mile they drive. In a report released Tuesday, the congressional watchdog agency suggested GPS surveillance devices or other, less invasive techniques could be used to more than double the amount of money motorists currently pay in federal gas tax fees.

GAO's auditors examined per-mile tax pilot projects in Minnesota, Nevada, Oregon and Washington to evaluate the benefits and downsides of gas tax replacement programs. At the federal level today, the 18.4 cents per gallon fuel excise tax generates $34 billion for the Highway Trust Fund, a fund GAO says faces future shortfalls as a result of Corporate Average Fuel Economy (CAFE) regulations.

An analysis of actual gas tax receipts shows funding has remained more steady than other traditional sources of tax revenue during an economic downturn. Shortfalls in the trust fund are more related to its use for non-highway purposes such as subsidies for users of mass transit.

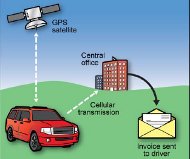

The most common form of per-mile tax involves having a GPS device that uses a cellular connection to regularly transmit location and mileage data to a centralized government office. This information would be processed so drivers could be billed. Another option would be a "pay at the pump" system that would eliminate GPS. In its place, wireless transponders would be installed on every vehicle that transmits only mileage information and the vehicle owner's identity to readers installed at fuel pumps. The tax would be added on to the cost of the gasoline. A third option would involve purchasing a pre-paid mileage allowance sticker that would be affixed to the windshield. This "road user charge" system is used for commercial trucks in New Zealand where the mileage is verified during inspections and traffic stops. Though the second and third options decrease privacy concerns, they also limit the ability of government officials to micromanage public behavior.

"Because pay-at-the-pump and prepaid manual systems do not collect location data on drivers they present fewer privacy-related challenges, but the trade-offs are reductions in the efficiency and equity of the proposed systems," the GAO report explained. "For example, they are unable to improve the efficiency of road use by charging drivers different rates for travel on specific roadways or during congested periods. Manual systems could also be subject to odometer fraud and evasion, with compliant drivers paying more than noncompliant drivers."

The benefit of the current gas tax system is that there is no tax evasion problem and the cost of collecting money from oil companies at the distributor level is minimal. On the other hand, installing GPS units on 230 million vehicles would be a "significant cost challenge" in GAO's words, consuming as much as 33 percent of the revenue collected over twenty years, including $55 billion in startup costs. On top of this, administrative costs would consume another 7 percent of revenues.

In Germany, 700,000 trucks carry tracking devices used to collect a $5 billion mileage tax. Administration and enforcement of this tax consumes $1.5 billion. Such systems have also proved problematic, as a test in Iowa found one out of every four participants experienced a failure with their tracking device that required bringing the unit in for service. GAO believes the GPS option is doomed.

"Because the public perception of privacy risks would be particularly acute in mileage fee systems that mandate the use of GPS technologies, the widespread implementation of such a system to cover all US passenger vehicles appears unlikely at this time," the GAO report concluded. "Although technology evolves rapidly and public perception can change over time, it may be impractical for the federal government to pursue mileage fees for all vehicles through a system that collects and reports information on people's movements for the purpose of assessing taxes."

A copy of the GAO report is available in a 2.3mb PDF file at the source link below.

Source: Pilot Program Could Help Determine the Viability of Mileage Fees (Government Accountability Office, 1/8/2013)

Permanent Link for this item

Return to Front Page

The Government Accountability Office (GAO) believes lawmakers should tax motorists for every mile they drive. In a report released Tuesday, the congressional watchdog agency suggested GPS surveillance devices or other, less invasive techniques could be used to more than double the amount of money motorists currently pay in federal gas tax fees.

The Government Accountability Office (GAO) believes lawmakers should tax motorists for every mile they drive. In a report released Tuesday, the congressional watchdog agency suggested GPS surveillance devices or other, less invasive techniques could be used to more than double the amount of money motorists currently pay in federal gas tax fees.