3/4/2013

More Redflex Executives Fall Over Bribery ScandalAustralian traffic camera company loses three more top officials in bribery scandal that could expand to other cities.

Heads continue to roll at Redflex Traffic Systems in the wake of an unfolding bribery scandal uncovered in Chicago, Illinois. The Australian photo enforcement firm admitted today that what it once called a $910 "billing error" -- the cost of a free room in a luxury hotel for John Bills, a city contracting official -- was part of a much larger, illegal influence scheme headed by Marty O'Malley, a Redflex consultant.

"The investigation concluded that the arrangement between the city program manager, the consultant, and Redflex will likely be considered bribery by the authorities," Redflex reported in a March 4 statement to the Australian Securities Exchange. "The arrangement was likely to be one in which some of the payments to the consultant would be paid to the city program manager, an arrangement apparently proposed by the city program manager."

According to the inquiry conducted by the law firm Sidley Austin, O'Malley was paid $2 million between 2003 and 2012 for his work in landing the nation's most lucrative photo ticketing contract. Redflex sent Bills on 17 different trips between 2003 and 2010, paying for everything including hotels, flights, car rentals, golfing, meals and a computer worth a total of $20,000. These items were placed on the expense account of Redflex executive vice president Aaron Rosenberg. Rosenberg was fired on February 20.

"At the least, the two former Redflex officials most involved in the consultant/city program manager arrangement (the CEO and former EVP) had knowledge that would have made any reasonable person highly suspicious that this was a bribery scheme, and they acted improperly in allowing this arrangement to occur," Redflex admitted.

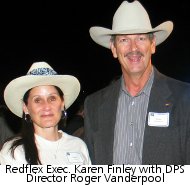

To clean up the mess, the company forced Karen Finley, the long-time CEO of US operations, to resign. Finley leaves with 346,106 shares now worth $391,100 -- reflecting a loss of about half their value in the last six months. She also holds 284,031 performance rights.

The scandal first came to light in August 2010 when an internal whistleblower informed Redflex management of the bribery arrangement. Instead of acting, officials at the company started a half-hearted investigation that covered up the incident -- for a time. Chief financial officer Sean Nolen examined Rosenberg's expense reports without interviewing individuals involved in the allegations. Nolen and Andrejs Bunkse, the general counsel were criticized for lying to the Chicago Tribune by calling the investigation "exhaustive." The Tribune did not drop the story which, without their reporting, would likely not have ever come to the public's attention.

Nolen and Bunkse were forced out of the company today, adding to the toll of ejected executives that includes Max Findlay, the chairman of the board and Ian Davis, a member of the board of directors. Even without the management changes, the company finds itself in serious financial trouble.

The company reported profit for the six months ended December 31, 2012 were cut in half from $7.2 million to $3.6 million thanks to growing resistance to automated enforcement. The firm reported 101 installations were removed, but only 54 new locations were added in six months.

"The slowing rate of new installations within the USA market has reduced the demand for capital to service that market," Redflex stated today in its half-yearly report. "In FY13, citizen initiatives caused the termination of several Redflex contracts at their term expiration."

So far, the company has also spent $1.2 million in legal fees related to the Chicago scandal. When Chicago's red light camera contract expires, Redflex will lose another 13.6 percent of its income. The company also warns of the possibility of bribery revelations in other cities.

"The current investigation may identify other instances of similar dealings with the city of Chicago and/or other jurisdictions," Redflex admitted to investors.

Trading in Redflex stock has been suspended since February 27. The suspension will be lifted on Tuesday.